M2 money supply prediction: It sounds like something out of a financial thriller, doesn’t it? Secret codes, whispered forecasts, and the fate of economies hanging in the balance. While the reality is slightly less dramatic (though still fascinating!), understanding how to predict M2 is crucial for navigating the often-murky waters of economic forecasting. This journey will equip you with the knowledge to decipher the complexities of M2, from its fundamental components to the sophisticated models used to anticipate its future movements.

Get ready to unlock the secrets of this vital economic indicator!

We’ll begin by defining M2 itself, exploring its relationship to other monetary aggregates like M1 and M3. Then, we’ll delve into the factors that influence M2 growth, including monetary and fiscal policies, and the powerful impact of macroeconomic forces. We’ll also explore various forecasting models, from the classic ARIMA to more innovative approaches, examining their strengths and weaknesses.

The practical aspects of data acquisition, cleaning, and analysis will be covered, ensuring you have the tools to build your own predictions. Finally, we’ll discuss interpreting those predictions, understanding their implications, and recognizing their inherent limitations. Buckle up, it’s going to be an exciting ride!

Defining M2 Money Supply: M2 Money Supply Prediction

Understanding the M2 money supply is crucial for grasping the overall health and direction of an economy. It’s a key indicator used by economists, investors, and policymakers to gauge economic activity and make informed decisions. Think of it as a vital sign for the financial heartbeat of a nation.M2 represents the total amount of money circulating within an economy, but with a broader scope than simpler measures.

It encompasses readily available cash, along with various near-cash equivalents, providing a more comprehensive view of liquidity and potential spending power.

Components of M2 Money Supply

M2 is built upon a foundation of more readily accessible funds, and then adds layers of slightly less liquid assets. These components offer a tiered view of money’s availability and accessibility. Understanding this hierarchy is key to interpreting M2 data effectively.M2 is composed primarily of M1, plus savings deposits, small-denomination time deposits, and money market mutual funds held by individuals.

Predicting the M2 money supply is a bit like gazing into a crystal ball, right? But understanding future trends is crucial. To get a clearer picture of the economic landscape influencing these predictions, check out the insightful forecasts from ihss news 2025 ; their analysis will help you navigate the complexities of monetary policy and its impact on the M2 money supply.

Ultimately, informed predictions are key to navigating the financial future.

M1, the base layer, includes physical currency in circulation and demand deposits (checking accounts). Adding the less liquid, but still readily accessible, elements of savings accounts and money market funds gives us the broader picture represented by M2.

Differences Between M1 and M2

The distinction between M1 and M2 lies in the inclusion of near-monies in the latter. M1 focuses solely on the most liquid forms of money – readily spendable cash and checkable accounts. M2 expands this definition to encompass assets that can be quickly converted into cash, though not as instantly as M1 components. Think of it like this: M1 is your readily available cash in your wallet; M2 includes that cash plus the money easily accessible in your savings account.For instance, while you can immediately use the money in your checking account (M1), accessing the funds in your savings account (part of M2) might involve a small delay, even if it’s just a quick online transfer.

Predicting the M2 money supply is a bit like forecasting the weather – tricky, but vital. Understanding its fluctuations helps us navigate economic currents. Need a break from the complexities? Check out la marathon 2025 promo code reddit for a dash of invigorating fun before diving back into the fascinating, albeit challenging, world of monetary policy analysis.

After all, a healthy body and mind are key to tackling those intricate M2 calculations!

This subtle difference reflects the varying degrees of liquidity within the broader monetary system.

Historical Overview of M2 Growth in the United States

The United States provides a compelling case study for M2 growth. Since the early 1960s, M2 has generally exhibited an upward trend, reflecting overall economic expansion and growth in financial assets. However, this growth hasn’t been consistently linear. Periods of rapid expansion, such as during economic booms and periods of expansive monetary policy, are often followed by periods of slower growth or even contraction during economic downturns or periods of tighter monetary policy.

For example, the significant increase in M2 following the 2008 financial crisis reflects the Federal Reserve’s efforts to stimulate the economy through quantitative easing. Analyzing this historical data helps to understand the relationship between monetary policy and economic cycles. Studying this data also reveals that understanding M2 requires context and consideration of the broader economic landscape.

Comparison of Monetary Aggregates

The following table illustrates the relationship between M0, M1, and M2, highlighting the progressive inclusion of less liquid assets. M3, while historically tracked, is no longer officially reported by the Federal Reserve.

| Monetary Aggregate | Description | Liquidity | Example |

|---|---|---|---|

| M0 | Monetary base; physical currency and commercial bank reserves | Highest | Physical cash held by banks and the central bank |

| M1 | M0 + demand deposits + other checkable deposits | High | Checking accounts, readily spendable funds |

| M2 | M1 + savings deposits + small-denomination time deposits + money market mutual funds | Medium | Savings accounts, money market accounts |

| M3 (Historically) | M2 + large-denomination time deposits + institutional money market funds | Lower | Large certificates of deposit |

Factors Influencing M2 Money Supply

Understanding the ebb and flow of M2, that crucial measure of the money supply, requires a keen eye on several key players in the macroeconomic arena. Think of it like a well-orchestrated symphony – each instrument (factor) plays its part, influencing the overall sound (M2 growth). Let’s delve into the fascinating interplay of these economic forces.

Key Macroeconomic Factors Influencing M2 Growth

Economic activity, in its many vibrant forms, significantly impacts M2. Strong economic growth typically leads to increased demand for money, boosting M2. Conversely, during economic downturns, businesses and consumers often hoard cash, resulting in slower M2 growth or even contraction. Imagine a bustling marketplace versus a quiet town square – the level of transactions directly affects the money in circulation.

For instance, the robust economic growth experienced in the years leading up to the 2008 financial crisis saw a corresponding surge in M2, a phenomenon clearly documented in various economic reports. This growth, however, ultimately proved unsustainable. The subsequent recession saw a sharp decline in M2 as economic uncertainty prompted a flight to safety.

The Impact of Monetary Policy on M2

Central banks wield considerable influence over M2 through monetary policy tools. One primary method is adjusting interest rates. Lowering interest rates encourages borrowing and spending, thus increasing M2. Raising rates has the opposite effect, slowing down economic activity and reducing M2. Think of it as a central bank’s lever, carefully calibrated to manage the money supply.

For example, the aggressive interest rate cuts implemented by the Federal Reserve following the 2008 crisis aimed to stimulate borrowing and spending, thereby boosting M2 and mitigating the economic downturn. Conversely, interest rate hikes implemented to combat inflation tend to curb M2 growth.

The Role of Fiscal Policy in Shaping M2

Fiscal policy, the government’s spending and taxing decisions, also plays a significant role. Government spending, particularly deficit spending, injects money into the economy, directly increasing M2. Conversely, tax increases can reduce the money supply. This is akin to the government acting as a significant player in the money market game. For instance, large-scale government stimulus packages, like those enacted during the COVID-19 pandemic, significantly boosted M2 through increased government spending.

The effect was quite dramatic, with M2 growing at an unprecedented rate.

Comparing Expansionary and Contractionary Monetary Policies on M2

Expansionary monetary policy, characterized by lower interest rates and increased money supply, directly increases M2. This fuels economic growth but can also lead to inflation if not managed carefully. Contractionary monetary policy, conversely, involves higher interest rates and reduced money supply, slowing down economic growth but potentially curbing inflation. The 1970s provide a classic example of the impact of expansionary monetary policy.

The combination of easy monetary policy and supply-side shocks led to a period of high inflation and rapid M2 growth. The subsequent shift towards contractionary policy helped to bring inflation under control, though at the cost of slower economic growth. It’s a delicate balancing act, requiring careful consideration of the trade-offs involved. Successfully navigating this requires foresight, skill, and a dash of good fortune.

The journey of M2 is a constant reminder of the dynamic relationship between monetary policy and the overall economy – a story constantly unfolding.

M2 Money Supply Forecasting Models

Predicting the future of M2, that fascinating beast of the financial world, is a bit like trying to predict the weather – challenging, but definitely not impossible! We’ve already explored what M2 is and the things that make it tick. Now, let’s dive into the exciting world of forecasting models, the tools we use to try and tame this economic wild card.

Predicting the M2 money supply is a bit like gazing into a crystal ball, right? It influences so much, including the performance of companies like Ideanomics. To get a clearer picture of potential market shifts, checking out this resource on ideanomics stock prediction 2025 might offer valuable insights. Ultimately, understanding the M2’s trajectory helps us navigate the economic landscape, offering a compass for smarter financial decisions.

It’s all interconnected, you see!

These models aren’t crystal balls, but they offer valuable insights into potential future trends.

Econometric Models for M2 Prediction

Several econometric models are employed to forecast M2, each with its strengths and weaknesses. These models leverage statistical techniques to analyze historical M2 data and identify relationships with other economic variables. The choice of model often depends on the specific goals of the forecast and the data available. For example, a simple linear regression might suffice for a short-term forecast, while a more complex vector autoregression (VAR) model might be necessary for longer-term predictions incorporating multiple interacting variables.

Sophisticated models can also account for structural breaks in the data – those unexpected jolts that can throw simpler models off course. Think of the unexpected shifts caused by global pandemics or sudden changes in monetary policy.

Predicting the M2 money supply is a bit like predicting the weather – tricky, but vital for economic planning. Sometimes, though, you need a break from the numbers, a moment of delicious escapism. Check out the amazing reviews for IMM Thai NYC imm thai nyc reviews – the perfect palate cleanser before diving back into those complex monetary aggregates.

Understanding the M2 money supply is crucial, but remember to treat yourself; you deserve it!

Time Series Analysis Techniques in M2 Forecasting, M2 money supply prediction

Time series analysis is a powerful tool in M2 forecasting. This approach focuses on the sequential nature of M2 data, looking for patterns and trends over time. Popular techniques include autoregressive integrated moving average (ARIMA) models, exponential smoothing methods, and more advanced models like SARIMA (Seasonal ARIMA) which account for seasonal fluctuations in M2. Imagine charting M2 over several years; you might notice a consistent upward trend, perhaps with seasonal dips and surges.

These patterns can be captured and used to extrapolate into the future. A successful model should capture these inherent cyclical patterns effectively. For instance, an ARIMA model might successfully forecast the typical increase in M2 during the holiday shopping season.

Predicting the M2 money supply is a bit like predicting the weather – tricky, but crucial for economic health. It’s all about understanding the flow of money, a fascinating dance of economic forces. So, while we ponder these financial currents, let’s take a quick detour: check out is blue bloods coming back in 2025 – a question far less predictable than the M2! Back to the money supply, though – its trajectory can paint a vivid picture of future economic growth or potential downturns, a crucial element for sound financial planning.

Advantages and Disadvantages of ARIMA Models for M2 Prediction

ARIMA models are frequently used for M2 forecasting due to their relative simplicity and effectiveness in capturing autocorrelations within the data. One major advantage is their ability to handle non-stationary time series – data that doesn’t fluctuate around a constant mean. However, ARIMA models can be sensitive to outliers and structural breaks, requiring careful data preprocessing and potentially model adjustments.

Another potential drawback is their inability to explicitly incorporate other economic variables, making them potentially less accurate than multivariate models in situations where external factors significantly influence M

2. Think of it like this

ARIMA is a great runner, but it needs a good map to navigate a complex terrain.

A Hypothetical Forecasting Model

Let’s craft a simple, yet illustrative, model. We’ll use two key indicators: the Federal Funds Rate (FFR) and real GDP growth. The FFR, the target rate banks charge each other for overnight loans, influences borrowing costs and, consequently, M Real GDP growth reflects the overall health of the economy, influencing demand for money and thus M

2. Our hypothetical model might take the form of a multiple linear regression

M2t = β 0 + β 1FFR t-1 + β 2GDP t-1 + ε t

Where:* M2 t is the M2 money supply at time t.

- FFR t-1 is the Federal Funds Rate at time t-1 (lagged one period).

- GDP t-1 is the real GDP growth at time t-1 (lagged one period).

- β 0, β 1, and β 2 are coefficients to be estimated.

- ε t is the error term.

This model suggests that past values of the FFR and GDP growth can help predict current M2. The coefficients would be estimated using historical data, revealing the strength and direction of each variable’s influence on M2. While this is a simplified example, it highlights the power of combining economic indicators to create a more robust forecast. Imagine the possibilities – by carefully selecting and weighting relevant economic factors, we can build more sophisticated models that offer increasingly accurate predictions of M2’s future trajectory.

It’s a thrilling pursuit, a dance between data and insight, leading us closer to understanding the intricate rhythms of the financial world.

Data Sources and Collection for M2 Prediction

Predicting the M2 money supply accurately requires a robust data foundation. This involves identifying reliable sources, selecting pertinent economic indicators, and meticulously cleaning and preparing the data for analysis. Think of it as building a sturdy house – you wouldn’t start constructing without a solid blueprint and high-quality materials, would you? The same principle applies to accurate M2 forecasting.Let’s dive into the nitty-gritty of acquiring and preparing this crucial data.

Getting it right is half the battle won!

Reliable Sources for Historical M2 Data

Accessing reliable historical M2 data is paramount. Imagine trying to navigate without a map – you’d be lost! Fortunately, several trustworthy sources provide this essential information. The Federal Reserve (Fed) in the United States, for example, is a goldmine of economic data, including detailed historical M2 figures. Their website, FRED (Federal Reserve Economic Data), is a user-friendly portal offering free access to a vast repository of economic time series.

Other central banks around the world, such as the European Central Bank (ECB) and the Bank of England, also publish comprehensive monetary data, often in easily downloadable formats. These institutions are the keepers of the economic kingdom, providing the raw materials for our predictions.

Relevant Economic Indicators for M2 Prediction

Predicting M2 isn’t about gazing into a crystal ball; it’s about analyzing interconnected economic factors. Several key indicators offer valuable insights into the dynamics of the money supply. These indicators act as our compass, guiding us towards a more accurate forecast. For example, interest rates significantly influence borrowing and lending, directly impacting M2. Similarly, GDP growth reflects the overall economic health, impacting the demand for money.

Inflation rates also play a crucial role, influencing both consumer spending and the central bank’s monetary policy decisions. Other factors such as consumer confidence indices, unemployment rates, and government spending can also provide valuable clues about the future trajectory of M2. Understanding the interplay of these factors is key to creating a truly insightful model.

Data Cleaning and Preprocessing for M2 Analysis

Raw data, like an unpolished gem, needs careful refinement before it can reveal its true value. Data cleaning is the process of identifying and correcting or removing errors, inconsistencies, and inaccuracies within the dataset. This might involve handling outliers, dealing with inconsistencies in data formats, and correcting obvious errors. For example, a negative value where a positive one is expected would need attention.

Preprocessing involves transforming the data into a format suitable for analysis. This often includes tasks such as standardizing units, converting data types, and handling missing values. Think of it as preparing ingredients before you start cooking a delicious meal – you wouldn’t throw everything into the pot raw, would you? Thorough cleaning and preprocessing ensure the integrity and reliability of our analysis.

Handling Missing Data in an M2 Time Series Dataset

Missing data is a common challenge in time series analysis. It’s like having a puzzle with missing pieces – you can’t get the full picture without filling in the gaps. Several techniques can effectively handle this. Simple imputation methods, like replacing missing values with the mean or median of the available data, are quick and easy but may not be suitable for all datasets.

More sophisticated methods, such as linear interpolation (estimating missing values based on the surrounding data points) or using more advanced time series models, can often provide more accurate results. The choice of method depends on the nature and extent of the missing data, and the potential impact on the analysis. The goal is to fill the gaps intelligently, preserving the integrity of the time series.

Remember, a little detective work can go a long way in solving the missing data mystery!

Interpreting M2 Predictions

Unlocking the secrets of M2 money supply predictions is like deciphering an economic treasure map. Understanding its nuances can guide us toward smarter financial decisions and a clearer picture of the economic landscape. Let’s dive into the fascinating world of interpreting these predictions.The M2 growth rate acts as a crucial economic pulse, reflecting the overall health and direction of the economy.

A steadily increasing M2, for instance, often suggests a robust economy with healthy levels of investment and consumer spending. Conversely, a stagnant or rapidly declining M2 might signal impending economic slowdown or even recession. It’s a key indicator, but not the sole determinant, of economic performance. Think of it as one piece of a much larger puzzle.

The Significance of M2 Growth Rate in Economic Analysis

The M2 growth rate’s significance lies in its ability to provide a forward-looking perspective on inflation and economic activity. A rapid increase in M2, if not matched by a corresponding increase in the production of goods and services, can lead to inflationary pressures. This is because more money chasing the same amount of goods inevitably drives up prices. Conversely, a slow M2 growth rate might indicate a weakening economy, potentially leading to deflationary pressures or even a recession.

Economists closely monitor this rate to anticipate potential economic shifts and inform policy decisions. For example, the Federal Reserve frequently uses M2 growth as one factor in setting interest rates.

Potential Implications of Different M2 Growth Scenarios

Different M2 growth scenarios paint distinct pictures of the economic future. A healthy, moderate growth rate, say around 4-6% annually (though this varies depending on the specific economic context and country), typically suggests a stable and expanding economy. This allows businesses to invest, consumers to spend, and overall economic prosperity to increase. Conversely, significantly higher growth rates can trigger inflation, potentially eroding purchasing power.

Think of it like this: if everyone suddenly has a lot more money, but the amount of goods remains the same, the price of those goods will inevitably rise. On the other hand, very low or negative M2 growth can signify a contracting economy, possibly leading to job losses and reduced consumer spending – a scenario that’s far less desirable.

Limitations of M2 Predictions and Potential Biases

While M2 predictions are valuable tools, they’re not crystal balls. Several factors can limit their accuracy and introduce biases. For example, changes in financial regulations, technological innovations (like the rise of digital currencies), and shifts in consumer behavior can all affect the relationship between M2 and economic activity. Additionally, the models used to predict M2 growth often rely on past data, which may not accurately reflect future economic conditions.

Unexpected events, like global pandemics or geopolitical crises, can completely throw off even the most sophisticated forecasts. It’s crucial to remember that M2 is just one piece of a complex economic puzzle.

Hypothetical Scenario Illustrating the Interpretation of an M2 Forecast and its Implications for Economic Policy

Let’s imagine an M2 forecast predicts a rapid increase of 10% in the next year. This scenario, coupled with other indicators suggesting robust economic growth, might lead policymakers to consider measures to curb inflation. They might raise interest rates to make borrowing more expensive, thereby slowing down economic activity and cooling inflationary pressures. Conversely, if the forecast indicated a significant slowdown in M2 growth, coupled with other signs of economic weakness, policymakers might consider implementing expansionary monetary policies – like lowering interest rates or increasing the money supply – to stimulate economic growth.

This illustrates how M2 predictions inform, but do not solely determine, economic policy decisions. It’s a crucial piece of information in a larger decision-making process. The interpretation of such a forecast would require a holistic view of the economy, not just focusing on the M2 figure in isolation.

Visualizing M2 Data and Predictions

Understanding the ebb and flow of the M2 money supply isn’t just about crunching numbers; it’s about seeing the story unfold. Visualizations are the key to unlocking this narrative, transforming complex data into easily digestible insights for everyone from seasoned economists to curious everyday folks. By crafting compelling visuals, we can make the often-abstract concept of M2 money supply both understandable and engaging.Let’s dive into how we can effectively present this data, bringing the numbers to life.

Line Graph of Historical and Projected M2 Growth

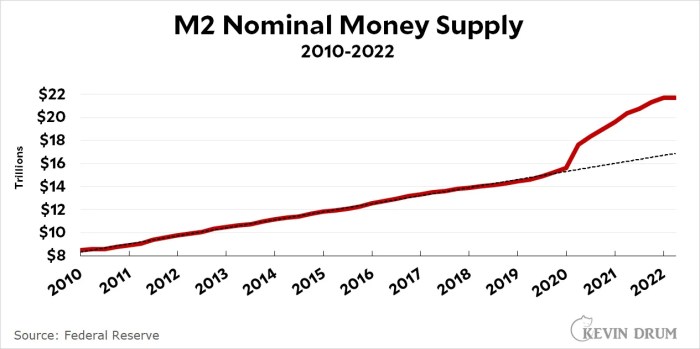

A line graph provides a dynamic and clear representation of M2 growth over time. Imagine a graph with the horizontal axis representing time (perhaps in years, from, say, 2000 to 2030), and the vertical axis representing the M2 money supply (in trillions of dollars, for example). The historical data would be plotted as a solid line, showing the ups and downs of M2 over the past years.

Then, a projected line, perhaps dashed or a different color, would extend the graph into the future, showcasing the predicted M2 growth based on our forecasting models. Key data points, such as periods of significant growth or contraction (like during a recession or a period of rapid economic expansion), should be clearly labeled and highlighted. For instance, you might label a specific point showing the sharp increase in M2 during the 2008 financial crisis and compare it to a projected slower growth in the coming years.

This visual immediately communicates the trends and potential future scenarios in a readily understandable manner. Think of it as a captivating story, unfolding before your eyes, revealing the pulse of the economy.

Bar Chart Comparing M2 Growth Across Different Time Periods

To highlight comparisons between different time periods, a bar chart is your best friend. This chart would present M2 growth rates for distinct periods – perhaps yearly growth rates over the last decade, or comparing average annual growth across different economic cycles (e.g., expansion vs. recession). Each bar represents a specific time period, with its height corresponding to the percentage change in M2 during that period.

Clear labeling of each bar with the time period and the percentage growth is essential. This allows for quick, intuitive comparisons. For example, a noticeably taller bar representing a period of rapid economic expansion immediately stands out against bars representing slower growth periods, effectively illustrating the relationship between economic activity and M2 growth. This is like having a snapshot of the economy’s heartbeat, allowing for easy comparison of different periods.

Effective Visualizations for Non-Technical Audiences

Communicating complex financial data to a non-technical audience requires a delicate balance of simplicity and accuracy. Think about using analogies and metaphors to make the concepts relatable. For example, you could compare the M2 money supply to the amount of water in a reservoir – increases represent inflows (e.g., government spending, bank lending), while decreases represent outflows (e.g., loan repayments, savings increases).

Interactive dashboards, where users can explore the data at their own pace, are also highly effective. Keep the visuals clean, uncluttered, and focused on the key message. Avoid overwhelming the audience with too much information. Instead, prioritize clarity and conciseness. A well-designed infographic, using charts and simple text, can be extremely powerful in explaining the implications of M2 predictions in a manner that resonates with a broad audience.

Remember, the goal is not just to present the data, but to tell a story that is both informative and engaging. Think of it as painting a picture with numbers, creating a visual narrative that is both beautiful and insightful. This approach transforms the potentially daunting task of understanding M2 into a compelling and accessible experience.